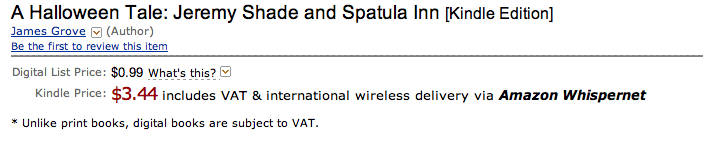

Last week, my 5,000 word short story, “Jeremy Shade and Spatula Inn” went on sale in the Kindle store. A big thanks to those of you who purchased the story. I even received a few edits which I have incorporated into the “next version” of the story.

However, there is one interesting addition to the story: VAT.

When you create a title on Amazon, the tell you that there will be an additional cost for buyers in countries where VAT is in play. If you read into the fine print, it doesn’t tell you exactly how much this will be. Well, now I know how much it is in one country. The screen capture below comes from a friend in Sweden:

Wow. That’s nearly 3x the price of the book!

Amazon’s own pricing information notes that there is a delivery fee for titles delivered on Kindle but it’s far below $2.45.

The Delivery Costs for a Digital Book will be equal to the number of megabytes we determine your Digital Book file contains, once uploaded by you and converted by us into our then-current Digital Book format, multiplied by $0.15 for sales in US Dollars and £0.10 for sales in GB Pounds. One megabyte equals 1024 kilobytes. One kilobyte equals 1024 bytes. We will round file sizes up to the nearest kilobyte. The minimum Delivery Cost for a Digital Book will be $0.01 for sales in US Dollars and £0.01 for sales in GB Pounds, regardless of file size.

In many countries, VAT does not apply to printed books. It does apply to digital content though… So, can that extra cost really be taxes?

This is really disturbing. I’d like to put more stories up on the Kindle but I don’t want people to pay 3X more. Yikes!!!

The top level of VAT in Sweden (according to Wikipedia) is 25% of the base price, so VAT for a 99 cent file should be 25 cents tops.

Amazon UK doesn’t add VAT (I just checked). Books are zero-rated here, and it appears that extends to the digital version, too, thank goodness.

Hi Jeremy,

I’ve just started uploading ebooks to Smashwords and came up against this irritating VAT problem. There is no joined-up thinking in the EU: one country charges 3% VAT, another 5% others (the UK at the moment) zero and according to what I understand resellers (Apple for one) take the VAT from your cover price – which isn’t what I really want. I would have thought that the sellers would add it to the cover price not take it off.

It seems to be a case of the producer of the work (the writer) getting ripped off again by the retailers. The only way to stop this, as I see it, is to refuse to have your books on companies that do this. Amazon needs writers more than writers need Amazon.

I also think Amazon are being pretty greedy making a delivery charge.

Good luck

Keith Gascoigne